Стратегия 2 Leg Lock Арбитраж

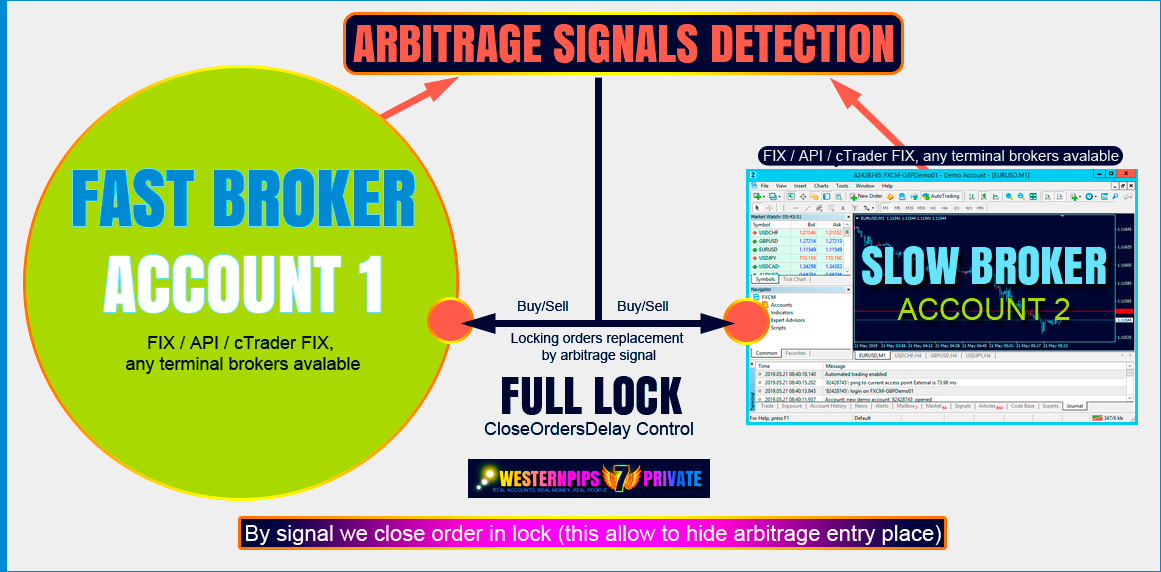

Алгоритм 2 Leg Lock Арбитраж

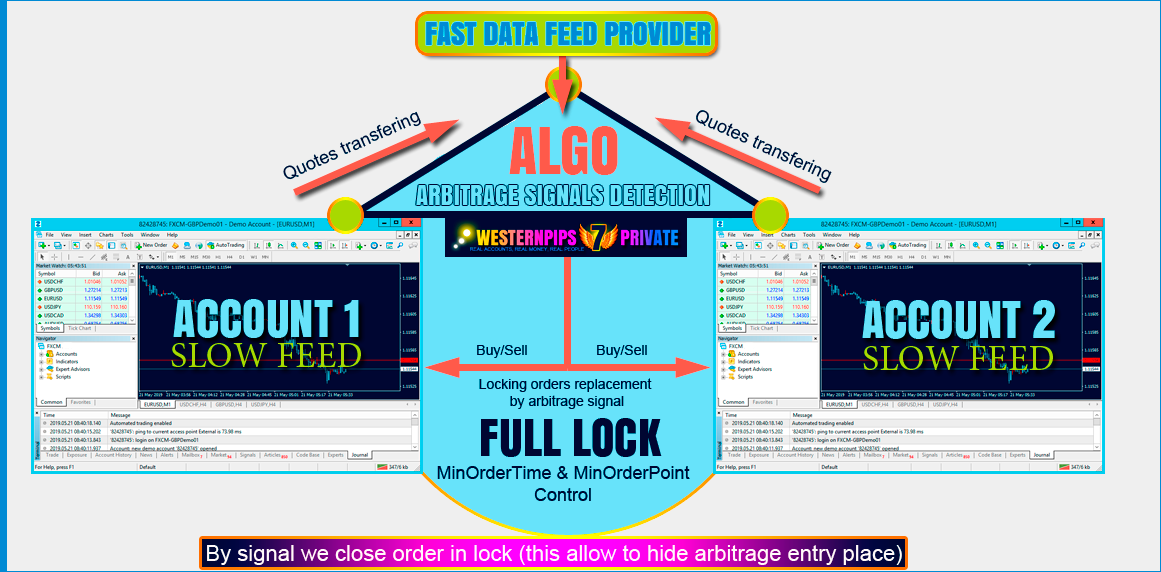

это новейшая разработка наших программистов. Основной целью создания этого алгоритма была полная маскировка и совершенно новый подход к арбитражу.

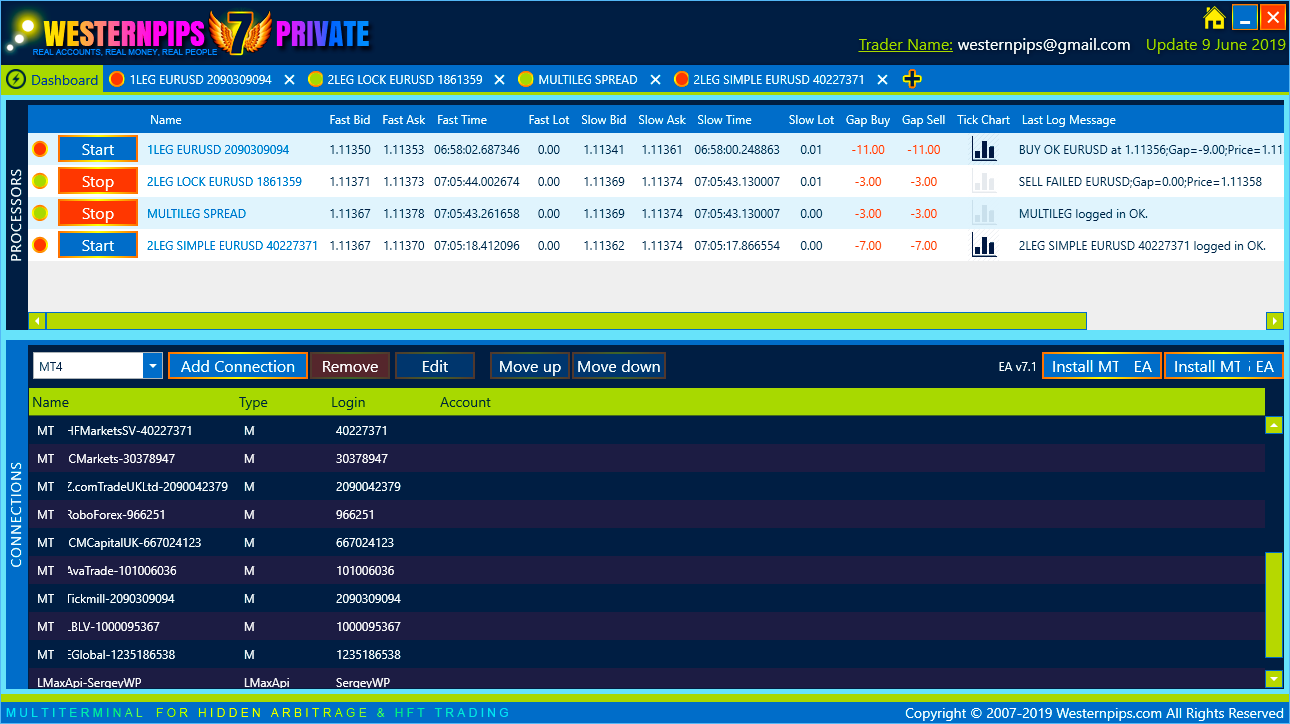

Классический алгоритм арбитража создает бешенную конкуренцию игроков на опережении цен в точке входа и остается все меньше шансов на исполнение сделки без проскальзывания.

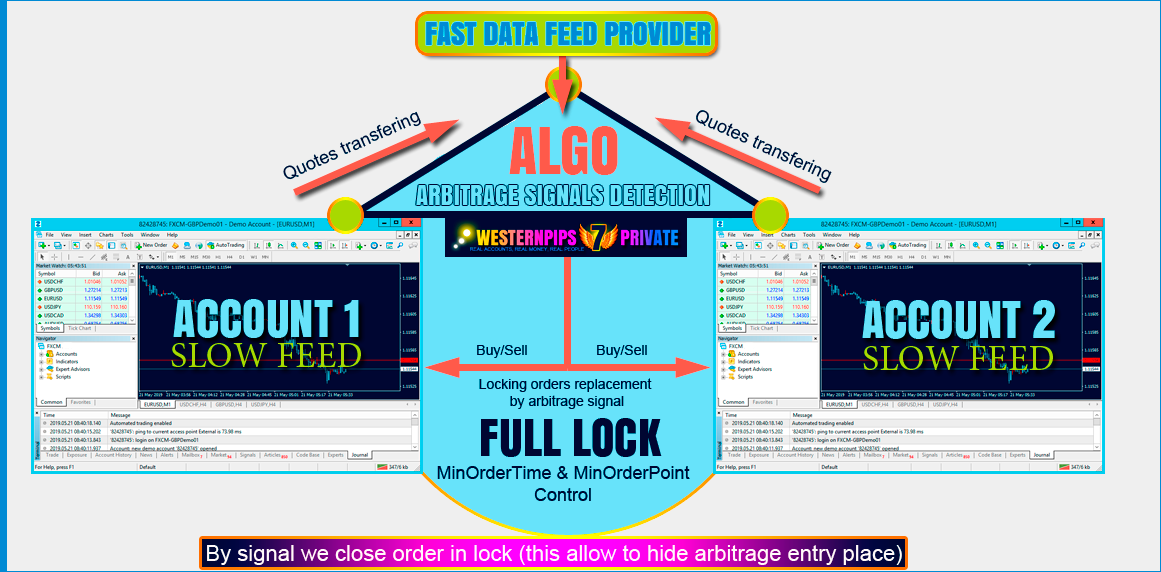

Чтобы решить эту проблему и при этом сохранить прибыльность стратегии нами был разработан новый алгоритм, в котором арбитражный сигнал уже не служит точкой входа в сделку,

а наоборот по сигналу закрывается уже давно открытая сделка. При этом торговля ведется параллельно на двух разных счетах медленного брокера (или на двух разных медленных брокерах).

У брокера остается все меньше шансов распознать применение арбитража/скальпинга на вашем счете потому что теперь длительность всех сделок превышает заданные лимиты,

и цены открытия сделок не совпадают с точкой разрыва цен, в истории счета все сделки выглядят хаотично - есть сделки с разным количеством пунктов прибыли/убытка и разной длительностью по времени,

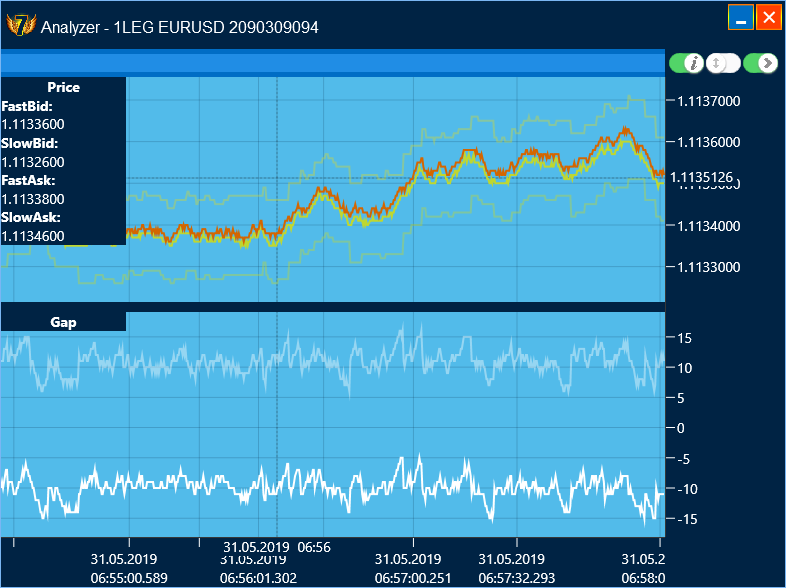

и все это надежный метод маскировки и защиты вашего счета. Для получения арбитражного сигнала применяется быстрый поставщик котировок,

а сами сделки открываются на разных счетах/терминалах двух медленных брокеров. Происходит плавный перелив капитала между счетами и рост общего суммарного депозита на двух счетах.

В алгоритме предусмотрен контроль направления ордеров buy/sell/full lock на обоих счетах, а также контроль возможных рисков.

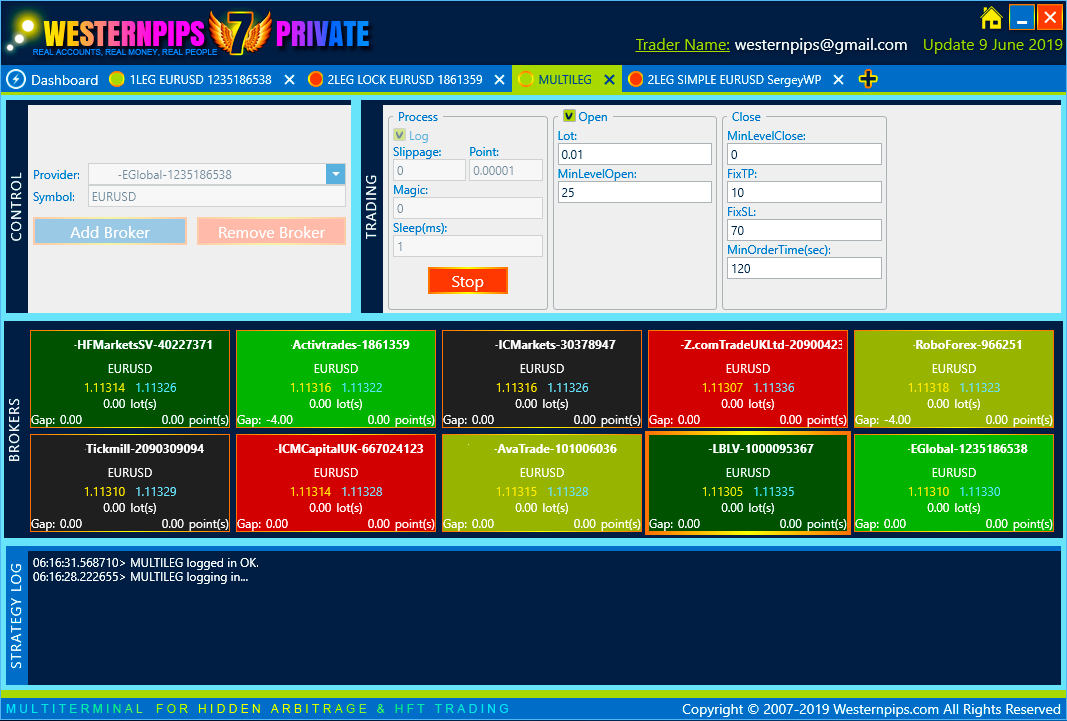

Multi Leg Spread Арбитраж

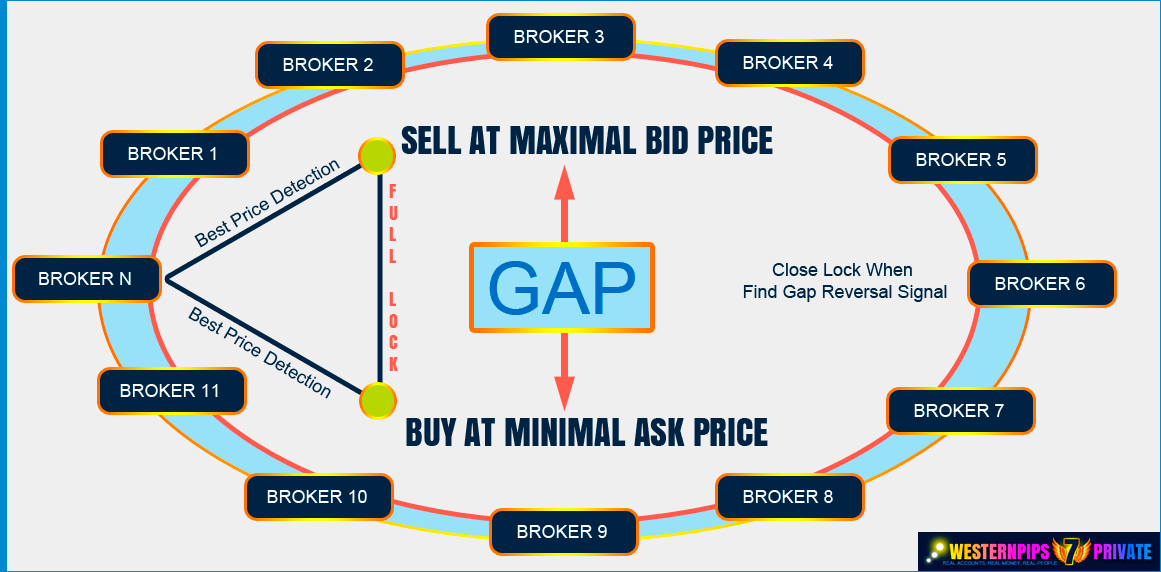

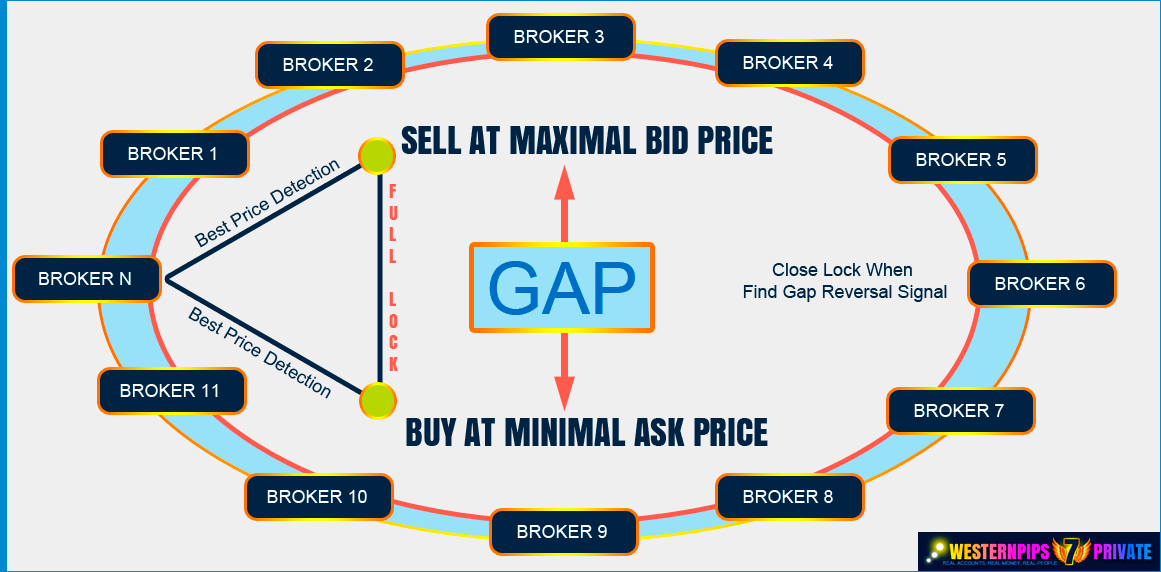

Алгоритм Multi Leg Spread Arbitrage или торговля спредом - это стратегия поиска расхождения цен на разных брокерах/поставщиках котировок.

Расхождение в ценах должно превышать величину спреда для успешной торговли. Эта стратегия применима на любых торговых инструментах и наш новый алгоритм

позволяет анализировать одновременно несколько разных брокеров и выбирать самые выгодные комбинации цен для совершения сделок.

Алгоритм подберет пару брокеров из добавленных вами с максимальным расхождением в ценах и откроет сделку BUY по самой низкой цене ASK и сделку SELL по самой высокой цене BID,

прибыль будет получена при возвращении цен в свой диапазон или при расхождении цен в обратную сторону.

Этот метод так же называется торговлей спредом или корреляцией.

Стратегия 2 Leg Simple Hedge

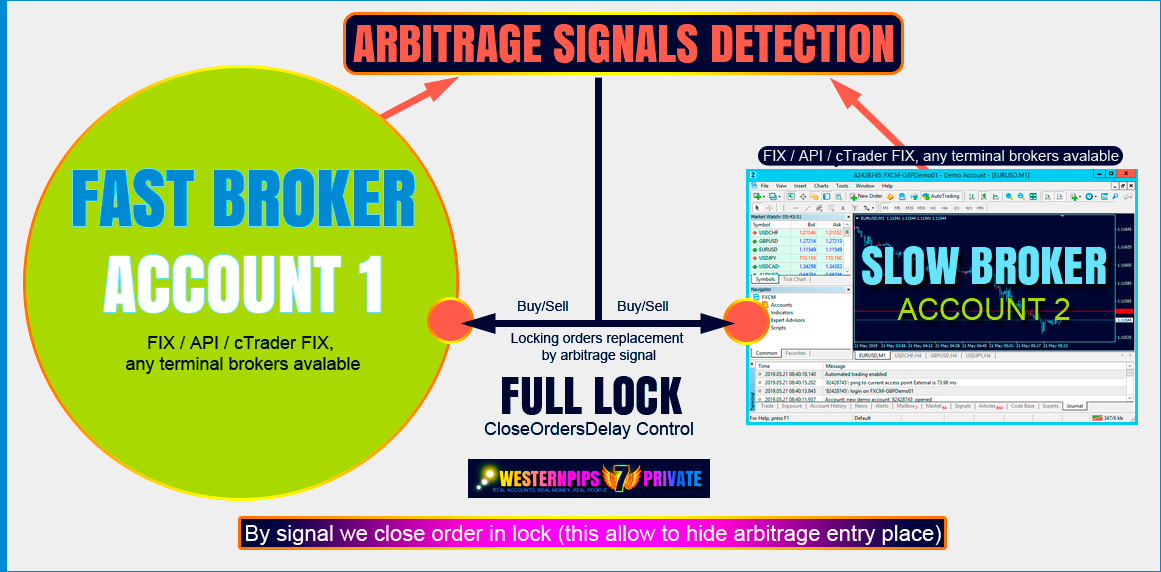

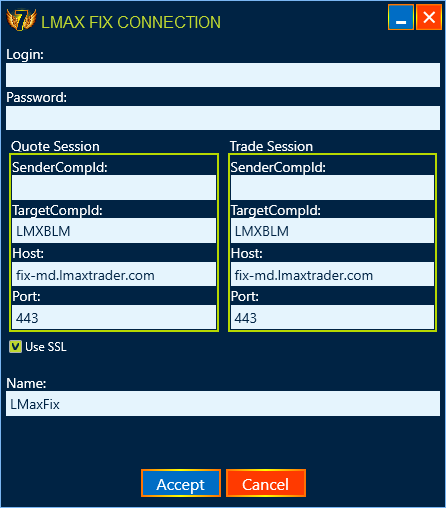

Алгоритм 2 Leg Simple Hedge это очень удобный и простой способ маскировки сделок через быстрого поставщика котировок.

В торговле учувствует медленный брокер и быстрый поставщик котировок на котором происходит локирование сделок для обеспечения защиты счета на медленном брокере от блокировки/бана.

Применение новой стратегии позволяет контролировать длительность сделок по времени и величине прибыли/убытка в пунктах.

Основным новшеством в алгоритме стала модель входа в сделку, теперь по сигналу арбитража мы не открываем сделку,

а закрываем одну из открытых сделок в локе, что позволяет избежать проскальзывания и скрыть место арбитражного входа от глаз брокера.

Для работы по этой стратегии вам потребуется наличие депозита для торговли на быстром поставщике котировок.